The Ultimate Cheat Sheet On Startup!

Starting a new business venture is exciting, scary, all that and more. Right? The journey of a thousand miles starts with a single step, they say. But what should that first step be? Here, we’re going to give you a quick cheat sheet, map out that first step – and the next one, and the […]

-

Starting a new business venture is exciting, scary, all that and more. Right? The journey of a thousand miles starts with a single step, they say. But what should that first step be?

-

Here, we’re going to give you a quick cheat sheet, map out that first step – and the next one, and the one after that.

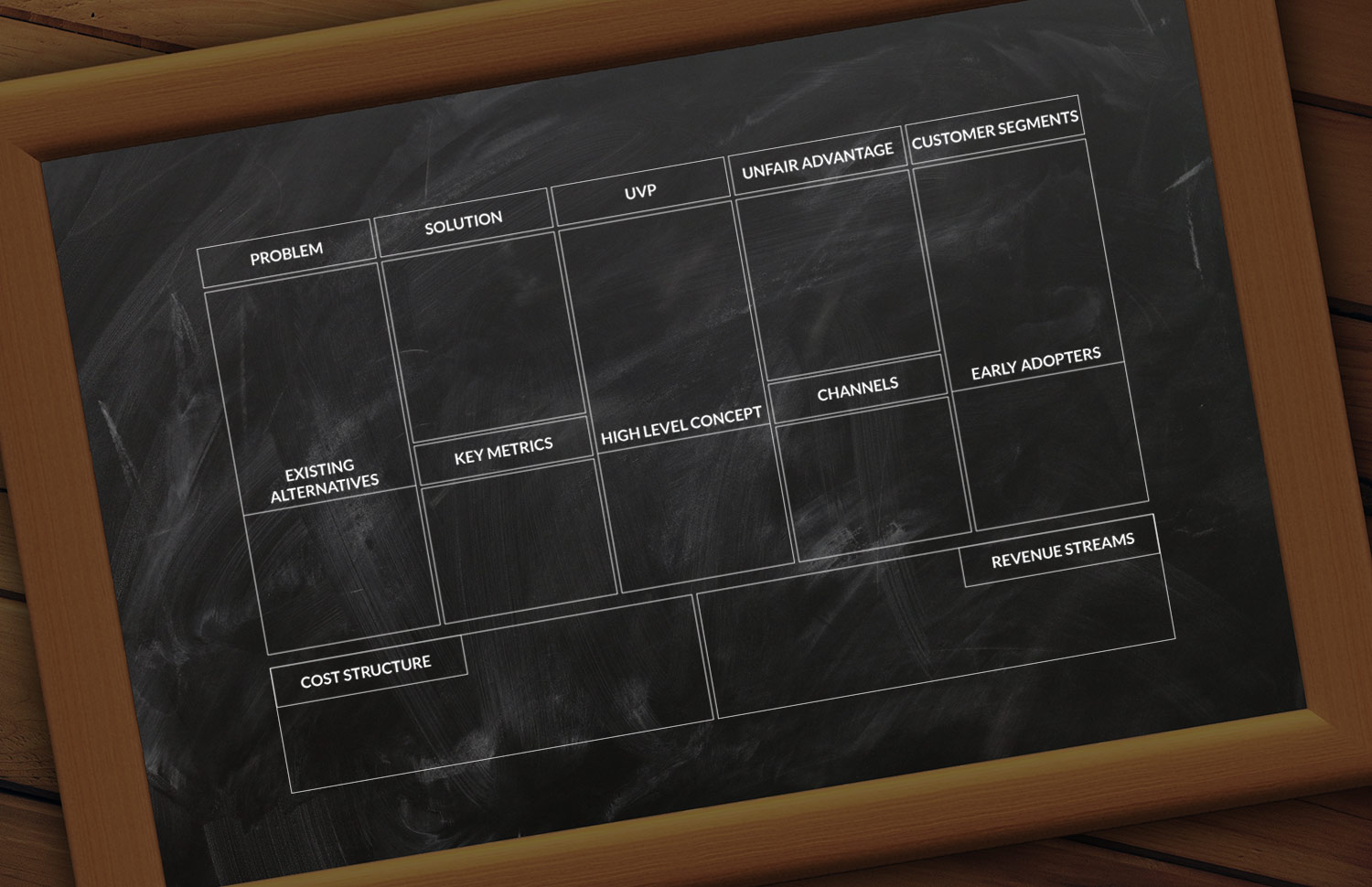

- The Idea. It all starts with the idea (or ideas.) What made you decide to start your own business today? Get those ideas down on paper. We strongly suggest starting with a lean canvas, a simple one-page plan that lets you see everything in a glance, weighing the costs and benefits together with the possibilities. Once you’ve decided what you want to do, don’t forget to apply for any relevant trademarks and copyrights.

- Market Research. Even the greatest product in the world needs an audience, and you need to know where it will fit in the current marketplace. What need – or want – will your idea satisfy? How are similar products faring? Who is buying them? What are the demographics related to your product – and how will that shape its overall design? Before you begin that first design phase, you should have a clear picture in mind.

- Customer Engagement. Don’t forget to ask potential customers what they think of your great idea. Even if your potential customers are members of your local community, ask what they think, ask what ways your idea is great – or not – and could be better – or not. If you don’t want to give too much away, you can still be subtle about it. Quietly query the potential marketplace and/or quietly observe relevant conversations, taking careful note of what people say they really want. Ultimately, however, the choice is up to you. People don’t always know – or say – what they really want, after all.

- Prototypes & Product Design. At some point, you will need to get serious about the idea. That means moving from an abstract concept to a functional product. At minimum, a prototype should perform all of the basic functions of the final product. It gives you a chance to work through design realities, explore materials and costs, and finally to show others what your idea will look like when it becomes reality.

- Getting the Team Together. Once you have your idea fleshed out and ready to go – or perhaps even sooner if you’re doing this all as a team, it’s time to think about who is going to partner with you all the way. Choose these people carefully, based on relevant expertise, yes, but also on shared vision. Even if you are a one-man show, consider networking as a way to find emotional support and business savvy. No one should go this road alone – and sooner or later you definitely won’t be.

- Investors and Where to Find Them. Getting investors can feel like a Catch-22 situation. Investors, it may seem, only want to invest in successful businesses who therefore don’t really need money. That is not necessarily true. If you have vision and commitment, especially as seen in hard work and personal investment and a sound business model, you might be surprised. That said, people aren’t going to come to you with money – and they (probably) aren’t going to offer money to a vague idea no matter how hard you ask.

- Try. Try Again. Last but not least, setbacks will come. There will be moments when that great idea doesn’t look so great, when that supplier lets you down, when that investor walks away shaking their head. The secret to success is not to give up. If you’ve done your research, if you’re sure your idea will fit a niche, don’t let momentary setbacks get you down. These things will happen. You can depend on it. You can also depend on your research and your idea that lets you know sooner or later you will get this product out there – and people will buy it.

All of this can seem daunting, we know. Good news: you aren’t in this alone. Wherever you are in the development of your business plan, whether you’re just getting or started or you’ve hit an inevitable snag, you need the right business partners to help see you through from concept to market – and beyond. contact us today, and let W3 Business Minds help with your startup!

Archives by Month:

March

- Why People Buy? What key factors determine they would do business with you?

- Special Guest – Raj Smriti

- Let’s catch the Thief that is stealing your success

February

January

- The 5 Sins of Marketing to avoid for success

- How to charge what you’re worth?

- Ever heard “Content is King” – Why ?

July

- 20 Myths About Business Success Revealed

- 4 Ways to Stop Burning Money in Ads but Still Get More Customers?

- What’s the Key to Creating Successful Conversion Content? and Grow Sales!

- Inbound Marketing – Perfect For People Who Hate Selling

- The Worst Advice We’ve Ever Heard About Sales

March

- What is Buyer’s Journey & Why it matters for your business?

- 4 Reasons why your Marketing efforts are not paying off or converting?

- The Benefits of Buyer Personas and How to Get Started?

- Why We Don’t Sell Any Project Without Discovery?

February

- 10 signs your website might be ready for an upgrade

- Why your business needs a technical co-founder…and where to find one?

January

December

- Startups Business – Determining if Your Business is Ready for Funding

- Five steps to attract investors

- How to Make a Successful Startup Business Plan.

- 10 Common Mistakes New Businesses Make

November

- 10 Crucial Errors to Avoid for Startup Businesses

- Spread the Word: 4 Ways to Enhance Your Online Presence

- $100 website vs a $10,000 website? What’s the difference?

- Brochure Website vs. Sales Person Website – What Really Works for You?

- $10,000?! For a website? Is a website worth that much ?

There are many excellent ideas that sound great in theory but do not result in a profitable business opportunity due to a lack of viability in today’s marketplace. Conversely, ideas that sounded almost nonsensical at the time (e.g. the pet rock) were wildly successful in the marketplace. Solid research provides the grounding for the numerical projections when making a capital request.

There are many excellent ideas that sound great in theory but do not result in a profitable business opportunity due to a lack of viability in today’s marketplace. Conversely, ideas that sounded almost nonsensical at the time (e.g. the pet rock) were wildly successful in the marketplace. Solid research provides the grounding for the numerical projections when making a capital request.

Even if a startup projects great growth during its first year, investors are going to want to see plans and projected growth over multiple years. The ‘holy grail’ that investors look for in a business is a potential to go public at some future point. Therefore, they will focus on the staying power of a business much more that a chance to turn a “quick buck”.

Even if a startup projects great growth during its first year, investors are going to want to see plans and projected growth over multiple years. The ‘holy grail’ that investors look for in a business is a potential to go public at some future point. Therefore, they will focus on the staying power of a business much more that a chance to turn a “quick buck”.

Investors are apt to not provide funding for any business that does not offer a specific payout for them at some specific point in the future. This payout can take many forms, especially for crowdfunding ventures, but the promise must be explicitly mentioned.

Investors are apt to not provide funding for any business that does not offer a specific payout for them at some specific point in the future. This payout can take many forms, especially for crowdfunding ventures, but the promise must be explicitly mentioned.