Startups Business – Determining if Your Business is Ready for Funding

Having the ability to raise capital is a key engine of growth in a startup business. However, before pursuing funding from venture capitalists (VC), other investors or through crowdfunding, a startup business must satisfy several requirements in order to not only increase its chances of obtaining the necessary funding but also to maximize the funding’s […]

Having the ability to raise capital is a key engine of growth in a startup business. However, before pursuing funding from venture capitalists (VC), other investors or through crowdfunding, a startup business must satisfy several requirements in order to not only increase its chances of obtaining the necessary funding but also to maximize the funding’s impact on the business. The four most critical requirements that capital markets will inspect very closely are:

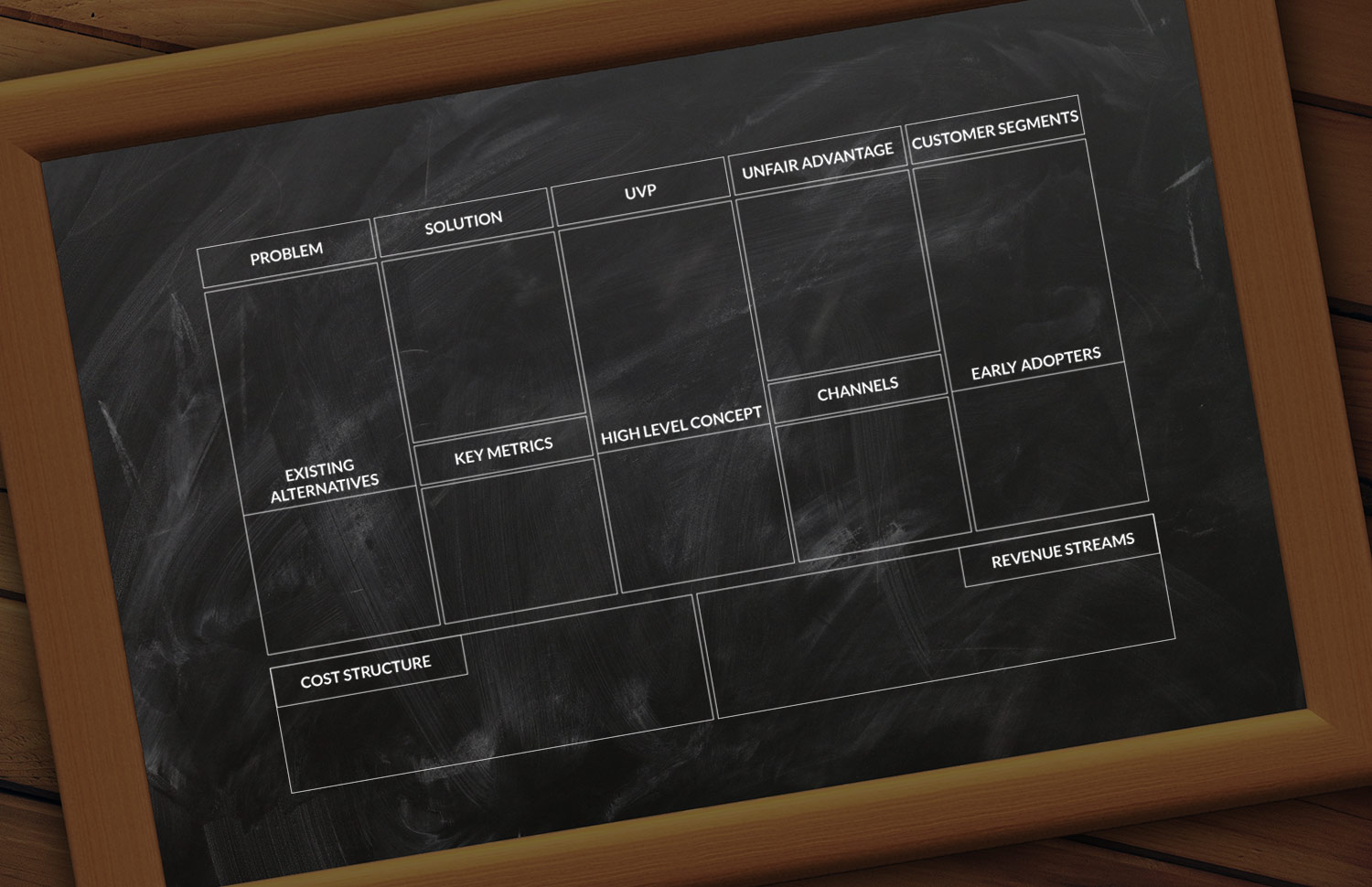

- 1. A complete business plan

- 2. Detailed market research

- 3. Realistic one and multi-year plans

- 4. The expected payoff for the investors

1. A Complete Business Plan

Without a detailed and realistic business plan, a startup will find themselves coming back empty-handed after meeting with investors. The business plan is the foundation upon which the startup will be built presenting an overall summary of the startup business and the method(s) by which it will make money and achieve profitability. A good business plan will provide documentation for projected business costs, sales, revenue, profit margins and potential areas of growth either organically or through acquisitions. A business plan should give a realistic data on when the startup is expected to achieve profitability.

2. Detailed market research

There are many excellent ideas that sound great in theory but do not result in a profitable business opportunity due to a lack of viability in today’s marketplace. Conversely, ideas that sounded almost nonsensical at the time (e.g. the pet rock) were wildly successful in the marketplace. Solid research provides the grounding for the numerical projections when making a capital request.

There are many excellent ideas that sound great in theory but do not result in a profitable business opportunity due to a lack of viability in today’s marketplace. Conversely, ideas that sounded almost nonsensical at the time (e.g. the pet rock) were wildly successful in the marketplace. Solid research provides the grounding for the numerical projections when making a capital request.

3. Realistic one and multi-year plans

Even if a startup projects great growth during its first year, investors are going to want to see plans and projected growth over multiple years. The ‘holy grail’ that investors look for in a business is a potential to go public at some future point. Therefore, they will focus on the staying power of a business much more that a chance to turn a “quick buck”.

Even if a startup projects great growth during its first year, investors are going to want to see plans and projected growth over multiple years. The ‘holy grail’ that investors look for in a business is a potential to go public at some future point. Therefore, they will focus on the staying power of a business much more that a chance to turn a “quick buck”.

4. The expected payoff for the investors

Investors are apt to not provide funding for any business that does not offer a specific payout for them at some specific point in the future. This payout can take many forms, especially for crowdfunding ventures, but the promise must be explicitly mentioned.

Investors are apt to not provide funding for any business that does not offer a specific payout for them at some specific point in the future. This payout can take many forms, especially for crowdfunding ventures, but the promise must be explicitly mentioned.

If your startup meets all of this criteria and you are ready to pursue funding, contact us and let us help you grow your startup.

Archives by Month:

March

- Why People Buy? What key factors determine they would do business with you?

- Special Guest – Raj Smriti

- Let’s catch the Thief that is stealing your success

February

January

- The 5 Sins of Marketing to avoid for success

- How to charge what you’re worth?

- Ever heard “Content is King” – Why ?

July

- 20 Myths About Business Success Revealed

- 4 Ways to Stop Burning Money in Ads but Still Get More Customers?

- What’s the Key to Creating Successful Conversion Content? and Grow Sales!

- Inbound Marketing – Perfect For People Who Hate Selling

- The Worst Advice We’ve Ever Heard About Sales

March

- What is Buyer’s Journey & Why it matters for your business?

- 4 Reasons why your Marketing efforts are not paying off or converting?

- The Benefits of Buyer Personas and How to Get Started?

- Why We Don’t Sell Any Project Without Discovery?

February

- 10 signs your website might be ready for an upgrade

- Why your business needs a technical co-founder…and where to find one?

January

December

- Startups Business – Determining if Your Business is Ready for Funding

- Five steps to attract investors

- How to Make a Successful Startup Business Plan.

- 10 Common Mistakes New Businesses Make

November

- 10 Crucial Errors to Avoid for Startup Businesses

- Spread the Word: 4 Ways to Enhance Your Online Presence

- $100 website vs a $10,000 website? What’s the difference?

- Brochure Website vs. Sales Person Website – What Really Works for You?

- $10,000?! For a website? Is a website worth that much ?